Car sales spike for second month

NEW-VEHICLE MOVEMENT jumped 19% year-over-year to 1.27 million units in April, as tariff-related fears drove pull-ahead vehicle demand, according to ZeroSum's May 2025 "State of the Dealer" report.

In the past two months, tariff fears have driven 341,000 units in accelerated new vehicle sales as consumers move to stay ahead of anticipated price hikes.

Used vehicles, though down 100,000 units to 1.37 million month-over-month, remained higher than normal, as they were up 12% compared to April of 2024. The spike in used-vehicle movement is also being affected by tariff dynamics as some consumers are gravitating to lower cost alternatives when they are at dealership lots.

"While the tariff picture is still coming into focus, the 341,000 pull-ahead sales that have occurred in the past two months will almost inevitably act as a drag on upcoming sales particularly if the expected price increases that drove those purchases in the first place become the new reality in the marketplace," says Josh Stoll, Vice President of Dealer Success at ZeroSum.

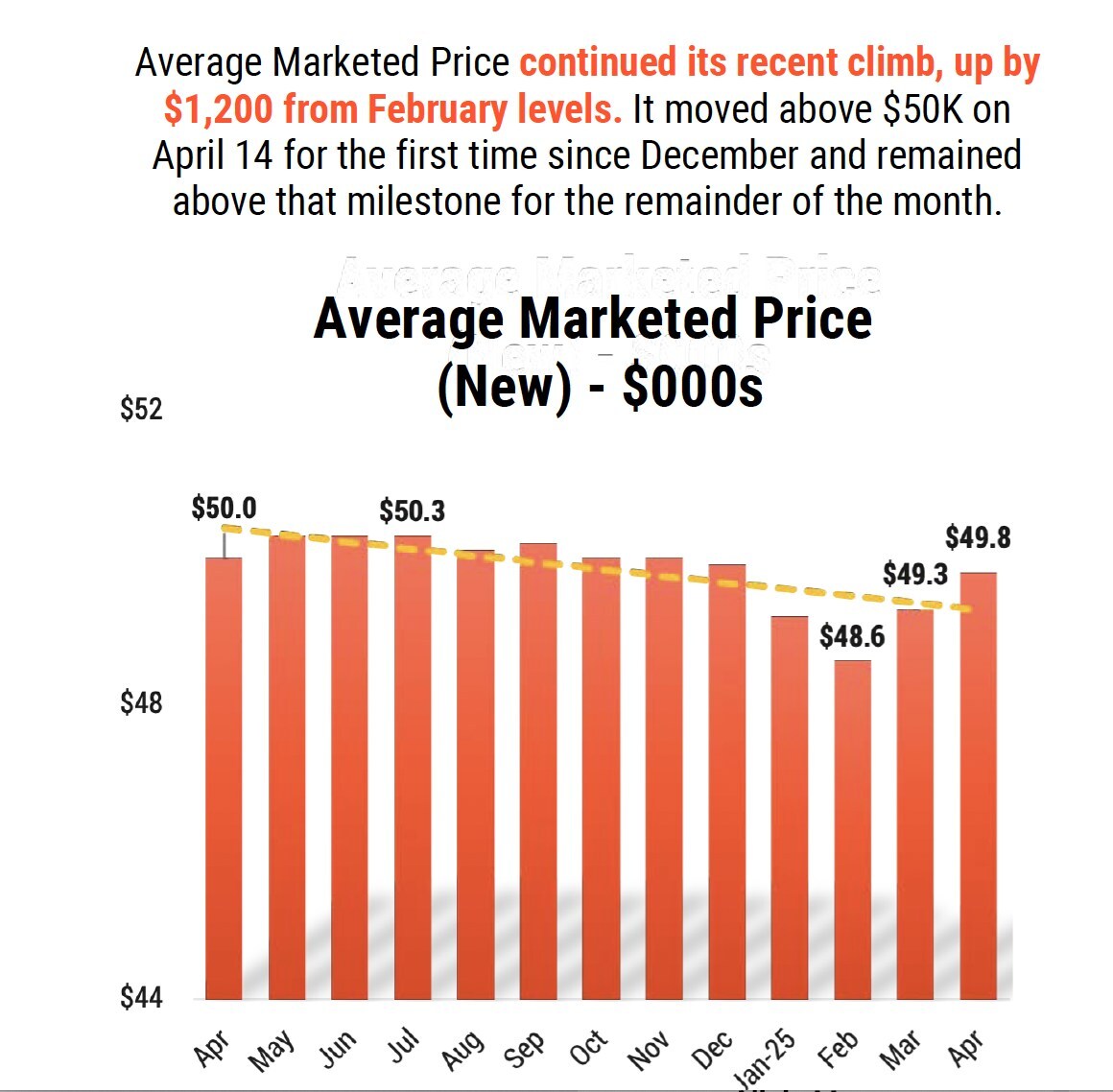

Average sales price moves above $50,000

Vehicle prices continued a steady climb in April, with Average Marketed Price for new vehicles up $1,200 from February levels. The average new vehicle price moved above $50,000 on April 14 for the first time since December 2024 and remained above that milestone for the remainder of the month.

Average Marketed Used vehicle prices leveled off month-over-month at $26,200, but are up $900 since February.

"Although Used Vehicle movement is pulling back from record highs that were previously seen in March, they are still elevated compared to historical standards," says Stoll. "It is apparent that this sector is already benefiting from high New Vehicle values among consumers who are getting priced out of the market or just searching for a better deal. And with tariff effects just getting started, used vehicles will be an increasingly important safe haven for consumers and dealers alike."